The health of your portfolio is like a stool, dependent upon three strong legs, i.e., economic issues, market issues, and geopolitical issues. But, how can you determine if the legs are strong enough to support the value of your portfolio?

Looking for economic data is definitely "drinking from a firehose." There is almost too much to absorb and is never 100% consistent. Nonetheless, I am confident when I say the economy is looking good -- not great, but good enough. I can support that with lots of data.

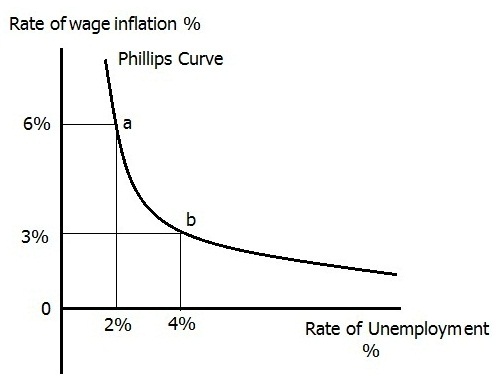

Looking for market data is a little more academic, but there is plenty to study, e.g., trading volume, advance/decline line, VIX, etc. There are lots of graphs, such as this one:

Looking for economic data is definitely "drinking from a firehose." There is almost too much to absorb and is never 100% consistent. Nonetheless, I am confident when I say the economy is looking good -- not great, but good enough. I can support that with lots of data.

Looking for market data is a little more academic, but there is plenty to study, e.g., trading volume, advance/decline line, VIX, etc. There are lots of graphs, such as this one:

The graph shows there is no reason to expect the long-term bullish trend to change, which is good news. Furthermore, corporate earnings growth looks to continue. There are even old Wall Street adages, like "the trend is your friend," suggesting you should stay bullish. There are lots of datapoints.

Looking for geopolitical data is another matter. It is much more subjective. What really matters? What doesn't? Is it presidential popularity? Is it war somewhere? Or peace elsewhere? Is it elections? How do you measure the strength of the geopolitical leg?

Your head can analyze the first two issues, but you need your stomach and decades of experience for the third issue.