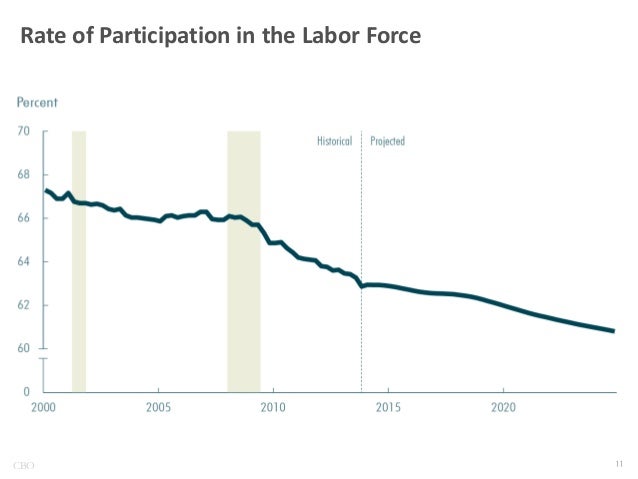

We've previously discussed the problem of the Labor Force Participation Rate. Fewer people are working. Conversely, more people are not working. Take a look at this graph and ask yourself why?

Republicans say this is a normal result from overly-generous worker's compensation and other entitlement programs. Democrats allege that half of the decrease is due to the aging of America, especially the baby-boomers who are retiring in record numbers. About a third of the decrease is cyclical, due to the weaker economy that simply does not need as many workers currently, and the remainder is due to workers simply giving up and living off others. Over time, the percentage of Americans who choose to work AND can actually find work is expected to decrease.

If I can produce 100 Big Mac calorie and/or cholesterol bonanzas each day and only produce 80, then economists will say I have an "output gap" of 20. The world would be better off (and less healthy) if I produced at my capacity. This idea of an output gap applies to the economy as a whole. Would America be better off if our Labor Force Participation Rate increased? Our GDP would increase. Our budget deficit would decrease. Even the dollar would likely increase. But, how would you do it?

You could try to un-do the cyclical weakness with deficit spending, but you would probably be hung-by-the-neck-until-dead by Congress. You could try to convince those who have already given up that the American Dream is not truly dead. Or, you could extend the retirement age. Perhaps, that would be enough to kick-start a little cyclical recovery and draw a few discouraged workers back into the Labor Force.

Since this recession has been called a "man-cession," it is not surprising that an unusually large portion of the discouraged workers are relatively young males. Maybe, we should fund a national shame campaign. If you love your son, you'll throw him out of the house. Maybe, Willie Nelson could even sing "Mothers, don't let your babies grow up to be slackers."