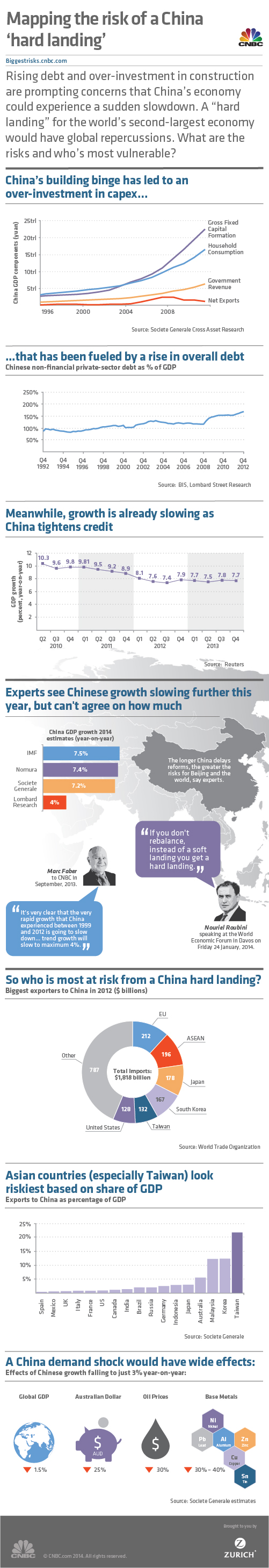

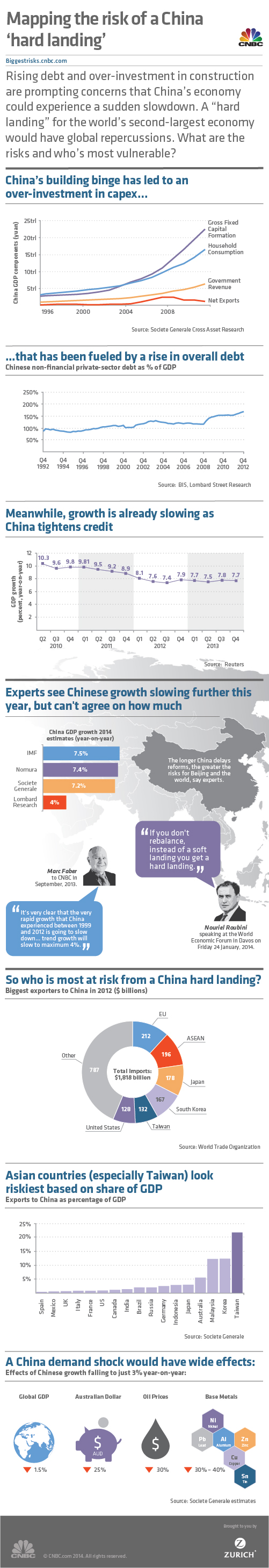

One of the reasons the stock market has been lackluster so far this year is fear of a slowdown in China, having a ripple effect on other emerging markets. Their PMI (Purchase Managers Index) has been signaling a mild slowdown. The world is afraid of a big slowdown. I don't think that will happen. Take a look at this nugget from CNBC:

The important thing to notice is that the share of GDP held by exports is decreasing and the share of consumption spending by people is increasing. As we've said in this space before, China is wisely trying to shift their economy from being export-oriented to consumption-oriented. This normally causes GDP growth to stall temporarily. While we will probably never see 10% growth rates again in China, we are more likely to see 7% growth than 2% (which is where the U.S. has been for many years).

Also, while their debt is raising fast, don't forget they have a trillion dollars worth of U.S. Treasury bonds, they can use to pay down the debt. Of course, they will have to exchange the bonds for the debt, rather than selling the bonds, but the point is that they can handle their debt. And, there is evidence they are reducing the growth of their debt.

Don't worry about China having a "hard landing." However, if you do want to worry, then worry about the currency crisis that is building among the emerging nations, which some analysts believe is related to the reducing level of quantitative easing.

(Normally, I worry a great deal about the opaque derivatives market, where nobody knows who is betting how much against whom or what nor when. Currency derivatives are less opaque than traditional ones, which means I worry less.)

The important thing to notice is that the share of GDP held by exports is decreasing and the share of consumption spending by people is increasing. As we've said in this space before, China is wisely trying to shift their economy from being export-oriented to consumption-oriented. This normally causes GDP growth to stall temporarily. While we will probably never see 10% growth rates again in China, we are more likely to see 7% growth than 2% (which is where the U.S. has been for many years).

Also, while their debt is raising fast, don't forget they have a trillion dollars worth of U.S. Treasury bonds, they can use to pay down the debt. Of course, they will have to exchange the bonds for the debt, rather than selling the bonds, but the point is that they can handle their debt. And, there is evidence they are reducing the growth of their debt.

Don't worry about China having a "hard landing." However, if you do want to worry, then worry about the currency crisis that is building among the emerging nations, which some analysts believe is related to the reducing level of quantitative easing.

(Normally, I worry a great deal about the opaque derivatives market, where nobody knows who is betting how much against whom or what nor when. Currency derivatives are less opaque than traditional ones, which means I worry less.)