When President Kennedy cut taxes, the economy boomed and the GDP grew nicely. When President Reagan cut taxes, the economy boomed and the GDP grew nicely. Since two dots make a line, does that mean that all tax cuts make the economy boom and GDP grow nicely? If so, why didn't the two Bush II tax cuts do the same?

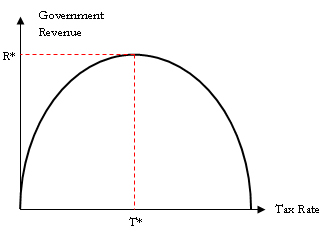

Below is the Laffer Curve by Arthur Laffer, the father of Supply-side economics. Now study it! If the economy is left of the vertical red line, you can increase taxes and government revenue will also increase. If the economy is right of the vertical red line, any further movement to the right or any increase in tax rate will actually lower revenues to the government, because taxes will begin strangling the economy.

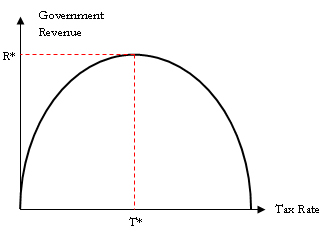

Below is the Laffer Curve by Arthur Laffer, the father of Supply-side economics. Now study it! If the economy is left of the vertical red line, you can increase taxes and government revenue will also increase. If the economy is right of the vertical red line, any further movement to the right or any increase in tax rate will actually lower revenues to the government, because taxes will begin strangling the economy.

Laffer argues the economy is somewhere far to the right of the vertical red line already, and any tax cut will actually increase revenue to the government. That's what happened when Kennedy and Reagan decreased tax rates.

The difference between Republicans and Democrats is that Republicans think the economy is on the RIGHT side of the vertical red line, while Democrats think the economy is on the LEFT side of that line.

But, what explains the success of Kennedy and Reagan, along with the failure of Bush II?

Taxes never exist in a vacuum. There are always other factors. Kennedy and Reagan were lucky enough to have a weak labor market and a low national debt-to-GDP level, which meant increases in the national debt were bearable. Bush II was not that lucky, and our national debt spiraled from his tax cuts. Another tax cut now would have the same effect - another explosive increase in our national debt without improving an already strong labor market.

Go to www.usdebtclock.org

No, stop what you are doing and go there . . . NOW!